Private Equity Leads Lighting M&A in North America

- derekbobbitt

- Jul 28, 2025

- 2 min read

Derek Bobbitt | Associate

Updated: July 28th, 2025

Key Takeaways

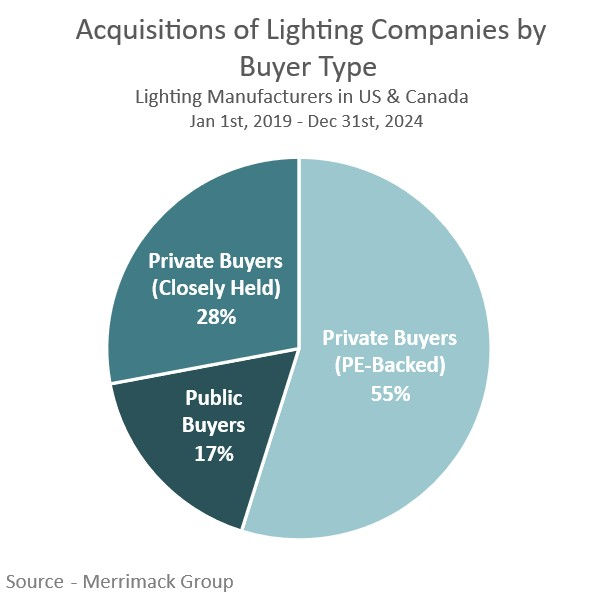

Private Equity (PE) accounted for 55% of lighting M&A deals in North America over the past six years

Lighting companies are attractive to PE firms due to industry fragmentation, ESG/sustainability relevance, and high growth in sectors like healthcare and building automation.

Despite skepticism, PE often supports long-term growth, talent retention, and phased exits.

Who's Buying Lighting Companies Today?

Our analysis of recent lighting deals shows which type of buyers are most actively acquisitive in M&A. Our team classified buyers into three categories:

Public companies

Private equity (PE) firms and their portfolio companies (PE-Backed Firms)

Independent private companies not controlled by PE (Closely Held Firms)

Why Are Private Equity Firms Investing in the Lighting Industry?

Private equity firms are increasingly drawn to the lighting industry for several strategic and financial reasons. Unlike public acquirers, which typically focus on larger transactions, PE buyers actively seek both platform and add-on acquisitions, including deals at the smaller end of the market.

Here’s what makes lighting attractive to PE:

Fragmented market ripe for roll-ups: With over 2,000+ lighting manufacturers in North America, the lighting market offers significant consolidation opportunities where PE can drive synergies, leverage operational efficiencies, and develop niche market leadership.

ESG relevance: Energy efficiency, sustainability, and smart building innovation position lighting squarely within many PE firms’ ESG investment mandates.

Sector innovation: Growth in healthcare, automation, and building intelligence has made lighting a tech-enabled systems play.

When evaluating whether a business qualifies as a platform or an add-on, PE firms typically consider the following criteria:

Platform investments typically start at $5M+ EBITDA, though some PE firms will evaluate strong companies with as little as $2M EBITDA.

Add-on acquisitions are often considered at any size, but most firms prefer EBITDA above $1M for efficiency and scale.

In today’s market, financial buyers are filling a critical gap: bringing both capital and operational know-how to growing businesses in the $1–10M EBITDA range that tend to be too small for public strategic buyers.

What are the Benefits of Selling to Private Equity?

It’s common for sellers to initially prefer a strategic acquirer over PE firms. This is often due to concerns about culture fit, micromanagement, or aggressive restructuring. However, after working with many reputable PE firms, our team and clients have seen firsthand the value they can bring to the table:

Stronger focus on talent retention: PE firms often prioritize keeping existing teams in place.

Flexible exit strategies: PE buyers often offer a unique path to retirement, encouraging owners to retain equity and remain involved during a transition period.

Respect for brand and culture: Unlike some strategics, PE firms are less likely to impose a new identity or operating model.

Support for add-on growth: PE firms often bring the capital and experience to help their portfolio companies grow through acquisition.

Merrimack Group is a boutique investment bank specializing in technology and manufacturing companies, with particular expertise in the lighting and fabrication industries.

Comments